4 3 Record and Post the Common Types of Adjusting Entries Principles of Accounting, Volume 1: Financial Accounting

11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. If the Final Accounts are prepared without considering these items, the trading results (i.e., gross profit and net profit) will be incorrect.

Adjusting Entries and Their Purpose FAQs

- In accrual-based accounting, journal entries are recorded when the transaction occurs—whether or not money has changed hands—in a general ledger (or general journal).

- You will notice there is already a credit balance in this account from other revenue transactions in January.

- To avoid this mistake, it is important to record transactions as soon as possible and ensure that they are accurate.

This is extremely helpful in keeping track of your receivables and payables, as well as identifying the exact profit and loss of the business at the end of the fiscal year. At Business.org, our research is meant to offer general product and service recommendations. We don't guarantee that our suggestions will work best for each individual or business, so consider your unique needs when choosing products and services. When you join PRO Plus, you will receive lifetime access to all of our premium materials, as well as 12 different Certificates of Achievement.

What are Adjustment Entries: An Overview

The main objective of maintaining the accounts of a business is to ascertain the net results after a certain period, usually at the end of a trading period. Adjusting entries will play different roles in your life depending on which type of bookkeeping system you have in place. Following our year-end example of Paul’s Guitar Shop, Inc., we can see that his unadjusted trial balance needs to be adjusted for the following events. We at Deskera offer an intuitive, easy-to-use accounting software you can access from any device with an internet connection.

Company

There are several types of adjustment entries, including accruals, deferrals, estimates, and reclassifications. Depending on your source, accounting professionals may recognize only four categories of adjusting entries, or up to seven. Additional types might include bad debts (or doubtful accounts), and other allowances. On September 30, 2022 (when the 12 months have expired), you would create another adjusting entry reflecting the rest of your prepaid rent (nine months or $15,000). For the most part, they look and function just like a regular journal entry. The main difference is the credit and debit values and when the transaction is recorded.

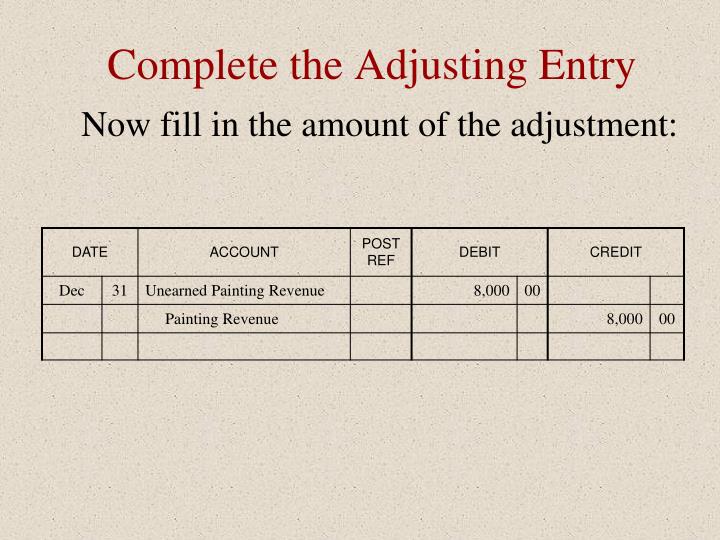

Deferred Revenue

Each type ensures accurate records are being kept of transactions in real-time. Sometimes companies collect cash from their customers for goods or services that are to be delivered in some future period. Such receipt of cash is recorded by debiting the cash account and crediting a liability account known as unearned revenue.

Adjusting Journal Entry: Definition, Purpose, Types, and Example

Your financial statements will be inaccurate—which is bad news, since you need financial statements to make informed business decisions and accurately file taxes. With the Deskera platform, your entire double-entry bookkeeping (including adjusting entries) can be automated in just a few clicks. Every time a sales invoice is issued, the appropriate journal entry is automatically created by the system to the corresponding receivable or sales account.

At the end of an accounting period during which an asset is depreciated, the total accumulated depreciation amount changes on your balance sheet. And each time you pay depreciation, it shows up as an expense on your income statement. Unpaid expenses are those expenses that are incurred during a period but no cash payment is made for them during that period. Such expenses are recorded by making an adjusting entry at the end of the accounting period. Companies that use accrual accounting and find themselves in a position where one accounting period transitions to the next must see if any open transactions exist.

For example, if an adjustment entry is made to defer revenue to a future accounting period, this will delay the recognition of revenue until the future period. Allowance for doubtful accounts is an estimate of the amount of accounts receivable that may not be collected. To record the allowance for doubtful accounts, an direct cost vs indirect cost cost accounting is made to increase the allowance for doubtful accounts expense account and decrease the corresponding asset account. Adjustment entries are an essential aspect of accounting that ensures financial statements are accurate and follow accounting principles.

For example, if a company has received payment for services that it has not yet provided, an adjustment entry is needed to record the revenue earned but not yet received. Adjustment entries are usually made in the general journal, which is used to record transactions that do not fit into any of the other journals. Each entry consists of a debit and a credit, and is recorded in accordance with the double-entry accounting system. Whether your employees are waiting on a commission check, or you owe a client money for materials, these expenses need to be reflected in an adjusting entry. Depreciation adjusting entries are used to spread out the cost of a fixed asset over time.

If you use accounting software, you’ll also need to make your own adjusting entries. The software streamlines the process a bit, compared to using spreadsheets. But you’re still 100% on the line for making sure those adjusting entries are accurate and completed on time.

This principle only applies to the accrual basis of accounting, however. If your business uses the cash basis method, there’s no need for adjusting entries. At first, you record the cash in December into accounts receivable as profit expected to be received in the future. Then, in February, when the client pays, an adjusting entry needs to be made to record the receivable as cash. Uncollected revenue is revenue that is earned during a period but not collected during that period.